2021年进入尾声,金融市场按照惯例会回顾过去 12 个月所作的投资决定的表现。与此同时,现在也是为投资者制定明年投资组合的好时机。

制定过程的第一步是要考虑现在美元的强势是否会持续。强势美元在不同的市场环境具有不同意义。

我们认为,美元作为一种“最后手段”的货币,在政策和经济不确定的期间会受到青睐。

不过,我们认为目前的美元升值是由于通胀预期上升,令美国国债收益率上升所致。纵使世界多国的央行已开始加息,但它们的影响力显然无法与联储局相提并论。

太一控股集团认为2022年之所以特别,是因为我们很可能看到从2015年以来美国首次加息,加上逐渐缩减购买资产规模,将对货币政策作出根本性改变。在加息环境下,投资者是否愿意像在无限流动性的时代一样,承担同样程度的股票风险?

对以上问题最审慎的答案是,投资者应在2022年持更加谨慎的态度。如果我们假设收益率上升,那么债券与股票之间将出现资金竞争。风险最大的是那些估值过高(如市盈率)或缺乏稳健盈利记录的公司。

换一个角度来分析,全球经济不再需要极低利率,加上强劲增长及价格上升,更高的利率可谓市场乐见的正常化迹象。由此可见,金融行业股票因经常在加息环境下表现出众,而被视为更具吸引力的选择。

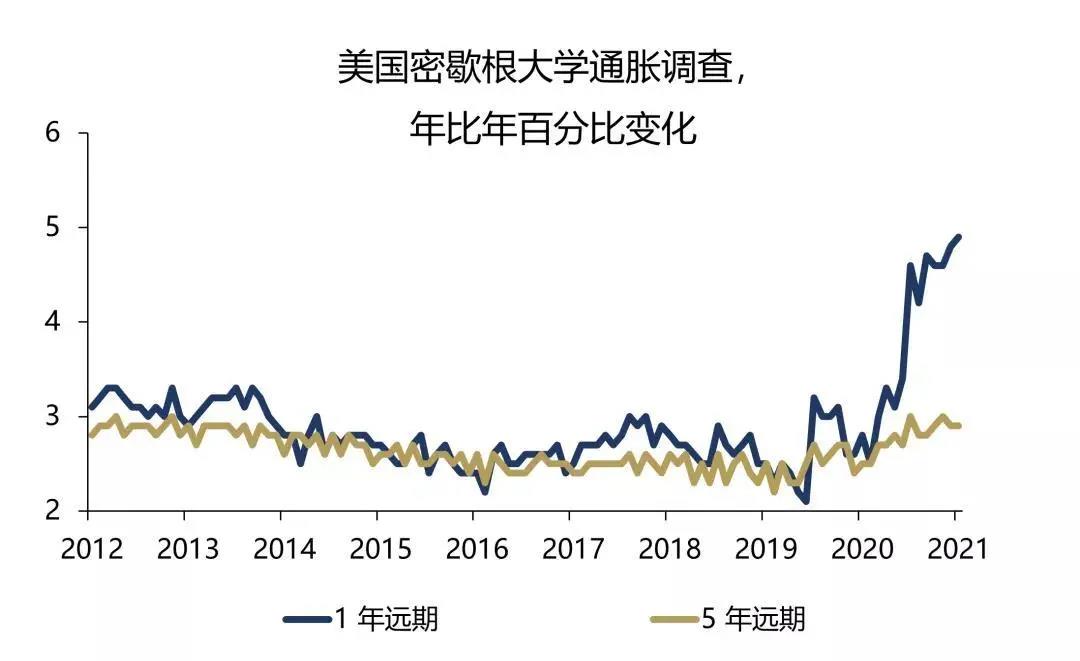

投资者最关注的问题是目前的通胀是否属于暂时性。对于新兴市场以外的投资者来说,现在的通胀水平非常罕见,因为在过去 30 年来央行成功兑现了保持低通胀的承诺。我们认为,市场现在正在经历从 1980 年代初以来第一次真正的通胀考验。

如果美国家庭对通胀的预期进一步显著上升,联储局是有可能加快原定的加息步伐。我们认为,这是 2022 年股市面临的最大单一风险。我们的基本观点是,通胀水平将在未来几个月见顶并失去动力,从而让利率稳步上升,而风险资产也得到支持。

2021 年股票市场表现的另一个特点是发达经济体股票与新兴市场股票之间的分歧。后者表现不佳显而易见,不少投资者甚至认为新兴市场股票现在的估值极具吸引力。

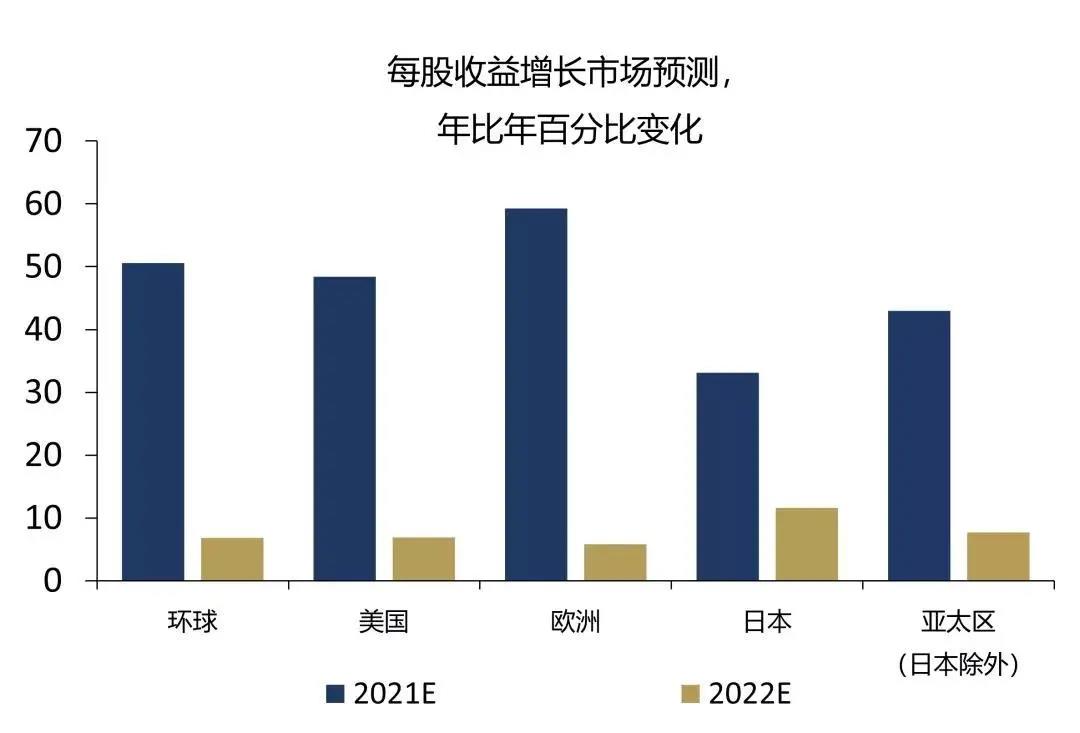

这种看法长远而言可能是正确的,但从短线考虑,发达市场的股票在 2022 年的表现仍看高一线。值得注意的是,市场普遍认为2022 年日本市场将有可观的盈利增长。总的来说,如下图所示,明年的企业利润增长速度预计将远低于今年。

尽管风险资产将会面临不利因素,但我们不应忽视宏观前景:全球经济仍在从新冠疫情中恢复过来。环球经济复苏进度参差不齐,而能够获取新冠疫苗和接种率较高的经济体,显然复苏得更快。

然而,过去一年的零售额和其他数据显示,只要情况许可,家庭对商品消费和服务均具有殷切需求。我们认为这股强劲的消费力将持续至明年,尽管在过程中将因为新冠疫情的反复出现而受到间歇性影响。

LGT皇家银行亚太私人银行首席投资策略师Stefan Hofer表示:“美国利率的上升速度仍然是目前最大的不明朗因素,但只要利率以渐进的方式上升,我们预计明年股票市场将录得比今年温和的正回报。”

Inflation is the wildcard for equity performance in 2022

As the end of the year approaches, it is customary in financial markets to review what investment decisions delivered positive returns over the preceding 12 months, and those that did not. At the same time, now is an opportune moment to set out the assumptions that may have the most impact on investors’ portfolios for the coming year.

Perhaps the first step in this process is to question whether the current strength of the US dollar will persist? A strong dollar can mean different things, under differing market environments. In our view the US dollar can see strong demand during periods of political or economic uncertainty, as a currency of “last resort”. Rather, we explain the dollar’s appreciation now as a function of rising US government bond yields given the increase in inflation expectations. While many central banks around the world have already increased interest rates, arguably their influence is unmatched relative to that of the US Federal Reserve. What makes 2022 unique is that we are likely to see the first US rate hikes since 2015. This is coupled with the gradual scaling back of asset purchases (so called tapering) which fundamentally changes the monetary policy backdrop. Will investors be willing to take on the same amount of equity risk in an environment of rising rates as they did during the era of seemingly endless liquidity?

The prudent answer to the above is that for 2022, more caution is warranted. If we assume that bond yields will rise, then there is an inevitable competition for capital between bonds and equities. The most vulnerable companies are those with very high valuations (for example, Price to Earnings multiples), and that don’t have a solid earnings track record. The other way to look at this dynamic is to argue that the global economy no longer needs extremely low interest rates, and given strong growth and rising prices, higher rates are a (welcome) sign of normalization. In this light, Financial stocks are often mentioned as an attractive option, as they tend to perform well in a rising rate environment.

The central question that investors seek an answer to is whether the current inflationary period will be short-lived or not. For investors outside of Emerging Markets, the inflation seen today is very rare. Indeed, the past 30 years has arguably been characterized by central banks’ commitment and success in achieving low inflation. In our view, we are now experiencing the first real test of this resolve since the early 1980’s. If household expectations of US inflation rise markedly further, then the US Federal Reserve could be forced to hike rates faster than currently assumed. In our view, this represents the single largest risk to equity markets for 2022. Our baseline view is that inflation will peak and lose momentum over the coming months, allowing for a gradual rise in interest rates, but not aggressive action that might undermine risky assets.

Another feature of equity market performance in 2021 has been the divergence between Advanced Economy equities and Emerging Markets. The underperformance of the latter is conspicuous, so much so that more market participants believe they are now attractively valued. On a longer-term horizon, this is likely to be true, however near-term considerations may see Developed Market stocks still perform better in 2022. Notably, the consensus outlook for earnings growth in 2022 favours the Japanese market. In general, profits are expected to increase at a far lower pace next year.

While some headwinds for risky assets are likely, we should not lose sight of the broader picture: the global economy is still emerging from the effects of the Covid-19 pandemic. The uneven nature of this recovery has admittedly been faster and stronger in those economies where Covid-19 vaccine access and distribution has been more efficient. What retail sales and other data over the past year demonstrate, however, is that once conditions permit, households have been enthusiastic buyers of both goods and services. We think this robust consumption will continue next year, albeit with the potential for sporadic pauses given the scope for flare-ups in the pandemic. The wildcard remains how fast US rates will increase – so long as rates rise in a gradual manner, then we expect another year of positive, if more modest, equity market returns.

编辑 | 铮铮向上

编审 | Leyla